RVs are a popular way to travel and explore the country, but purchasing one can come with a plenty of costs you may not have considered. One of the costs that RV buyers need to consider is the sales tax, which varies depending on the state.

RV sales tax by state varies greatly, and some states even have additional local taxes. The states that do not charge sales tax on RV purchases are Alaska, Delaware, Montana, New Hampshire, and Oregon.

RV owners may also need to pay registration fees and other taxes, such as personal property taxes. Understanding these costs is crucial for budgeting and avoiding any surprises down the road.

We’ll cover everything you need to know in this guide.

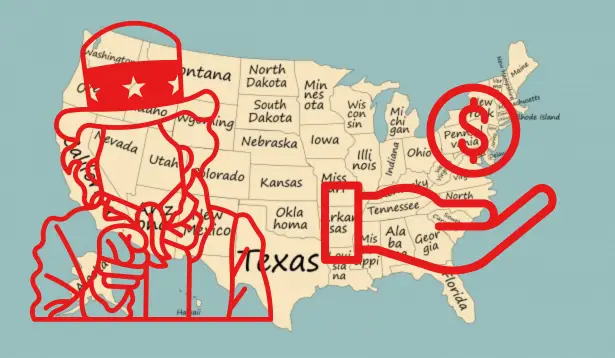

RV Sales Tax By State

When purchasing an RV, it is important to consider the sales tax that will be imposed by the state where the purchase is made. Sales tax rates vary by state, and some states have exemptions or reduced rates for RV purchases. Here is an overview of RV sales tax in each state:

Alabama

The RV sales tax rate in Alabama is 2%, but there is an additional county and city tax that can bring the total tax rate up to 3.375% to 4%.

Alaska

Alaska does not have a statewide sales tax, so there is no sales tax on RV purchases in Alaska. Some local tax rates on RVs in Alaska can be up to 7.5%.

Arizona

The RV sales tax rate in Arizona is 5.6%, but there is an additional city or county tax that can bring the total tax rate up beyond that percentage. RV purchases must be registered within 15 days of the RV sale being finalized in Arizona.

Arkansas

The sales tax rate in Arkansas is 6.5%, but there is an additional county tax that can bring the total tax rate up to 11.5%. There is no sales tax on RV purchases under $4,000 in Arkansas.

California

The sales tax rate in California is 7.25%, but there is an additional district tax that can bring the total tax rate up to 10.25%. You must register your RV in California within 10 days of purchase.

Colorado

The sales tax rate in Colorado is 2.9%, and you may see additional city, county, and district tax rates in addition to that. You must register your RV in Colorado within 60 days of purchase.

Connecticut

The sales tax rate in Connecticut is 6.35% for RV sales under $50,000, and 7.75% on RV sales over $50,000. Your RV must also pass an emissions test in Connecticut.

Delaware

Delaware does not have a sales tax, so there is no sales tax on RV purchases in Delaware.

Florida

The sales tax rate in Florida is 6%, but there is an additional county tax that can bring the total tax rate up to 8.5%. There are additional local sale taxes applied to the first $5,000 of the sales price of the RV or motorhome. All sales taxes are applied to any RV sold or delivered in Florida.

Georgia

The sales tax rate in Georgia is 7%, and you must register the RV within 60 days of purchase.

Hawaii

The sales tax rate in Hawaii is 4.712%, and there may be additional county taxes to consider. You must register your RV within 30 days of purchase in Hawaii.

Idaho

The sales tax rate in Idaho is 6%, and you must register the RV within 60 days of purchase.

Illinois

The sales tax rate in Illinois is 7.25%, and you must register the RV within 20 days of purchase.

Indiana

The sales tax rate in Indiana is 7%, and you must register the RV within 45 days of purchase.

You do not need to pay sales tax if you are a nonresident purchasing the RV in Indiana, unless you live in AZ, CA, FL, HI, MA, MI, NC, or SC.

Iowa

The sales tax rate in Iowa is 5%, and you must register the RV within 30 days of purchase.

Kansas

The RV sales tax rate in Kansas is between 7.3% and 8.775%, and you must register the RV within 90 days of purchase.

Kentucky

The sales tax rate in Kentucky is 6% for RV purchases.

Louisiana

The sales tax rate in Louisiana is 4%, but there is an additional parish tax or local tax that can vary between 1.85% and 7%.

Maine

The sales tax rate in Maine is 5.5%, and you must register the RV within 40 days of purchase.

Maryland

The RV sales tax rate in Maryland is 6% for RVs that are 7 years or newer. There is no sales tax on RVs older than 7 years.

Massachusetts

The RV sales tax rate in Massachusetts is 6.25%.

Michigan

The sales tax rate in Michigan is 6%, and you must register the RV within 15 days of purchase.

Minnesota

The sales tax rate in Minnesota is 6.5%, and you must register the RV within 60 days of purchase.

Mississippi

The sales tax rate in Mississippi is 5%, and you must register the RV within 30 days of purchase.

Missouri

The sales tax rate in Missouri is 5%, and you may have additional city or county taxes. You must register the RV within 30 days of purchase.

Montana

Montana does not have a sales tax, so there is no sales tax on RV purchases in Montana.

Nebraska

The sales tax rate in Nebraska is 5.5%. You must register the RV within 30 days of purchase

Nevada

The sales tax rate in Nevada is 8.1%, and you must register the RV within 30 days of purchase.

New Hampshire

New Hampshire does not have a sales tax, so there is no sales tax on RV purchases in New Hampshire. You must register the RV within 20 days of purchase.

New Jersey

The sales tax rate in New Jersey is 7%. You must register the RV within 60 days of purchase.

New Mexico

The sales tax rate in New Mexico is 4%. It’s important to note that New Mexico will only charge tax on the sales portion of the RV less any trade-in credit. You must register the RV within 30 days of purchase.

New York

The sales tax rate in New York is 4%, but there is an additional county tax that can bring the total tax rate up to 8.5%.

North Carolina

The sales tax rate in North Carolina is 3%, up to a maximum RV sales tax of $2,000. You must register the RV within 30 days of purchase.

North Dakota

The sales tax rate in North Dakota is 5%. You must register the RV within 75 days of purchase.

Ohio

The sales tax rate in Ohio is 5.75%, and there is an additional county tax that can bring the total tax rate up to 7.75%.

Oklahoma

Oklahoma charges a flat fee RV sales tax of $20 for the first $1,500 spent on any RV. The sales tax is 3.25% of the total purchase price after the initial $1,500.

Oregon

There is no RV sales for personal use RVs in Oregon, but the state does charge a 1.5% tax for an RV registered to an LLC. You must register the RV within 30 days of purchase.

Pennsylvania

Pennsylvania charges 6% RV sales tax statewide, but the tax rate also varies by county. For example, the City of Philadelphia has an 8% tax rate, while Allegheny county has a 7% tax rate.

Rhode Island

Rhode Island charges a 7% RV sales tax on the purchase price after trade-in credits and allowances are deducted. You must register the RV within 30 days of purchase.

South Carolina

The sales tax rate in South Carolina is 6%, and you must register the RV within 30 days of purchase.

South Dakota

The sales tax rate in South Dakota is 4%, and you must register the RV within 45 days of purchase.

Tennessee

Tennessee’s RV sales tax rate is 7%.

Texas

Texas charges an RV sales tax rate of 6.25%, less any trade-in credits on the purchase amount. You must register the RV within 30 days of purchase.

Utah

There is an RV sales tax of 6.85% in Utah, along with an RV dealer documentation fee of $149. You must register the RV within 60 days of purchase.

Vermont

There is an RV sales tax of 6% in Vermont. You must register the RV within 60 days of purchase.

Virginia

Virginia has an RV sales tax rate of 4.15%, and you must register the RV within 30 days of purchase.

Washington

There is an RV sales tax rate of 6.5% in Washington, and you must register the RV within 30 days of purchase.

West Virginia

West Virginia charges 6% sales tax on RVs and motorhomes, and you must register the RV within 30 days of purchase.

Wisconsin

Wisconsin’s RVsales tax rate is 5%, but can come out to a total tax rate of around 5.51% after you factor in county taxes and stadium taxes. Some Wisconsin RV dealerships may also charge a service fee of $99.

Wyoming

Wyoming has a 4% sales tax on RVs for most parts of the state, but can go a little higher based on what part of the state you purchase in.

How To Avoid Sales Tax On An RV Purchase

When purchasing an RV, one of the significant expenses that buyers face is sales tax. However, there are ways to avoid paying sales tax on an RV purchase. Here are some ways to do it:

Register the RV Under a Legitimate LLC

One of the ways to avoid paying sales tax on an RV purchase is to register the vehicle under a legitimate Limited Liability Company (LLC). This business structure is similar to a Delaware corporation and can help reduce the sales tax liability.

RV buyers looking to avoid RV sales tax must ensure that they follow all the legal requirements and regulations when setting up an LLC to avoid any legal issues.

Buy an RV In a State With No Sales Tax

Another way to avoid paying sales tax on an RV purchase is to buy the vehicle in a state that does not charge sales tax.

Alaska, Delaware, Montana, New Hampshire, and Oregon do not charge sales tax on RV purchases.

RV buyers should be aware that some states (usually referred to as non-reciprocal states) may add sales tax when they make an out-of-state purchase.

Additional RV Ownership Costs and Deductions

Aside from sales tax, there are other costs associated with purchasing an RV that buyers should be aware of. These include registration fees, insurance costs, loan interest, personal property tax, and motor vehicle document fees.

Registration fees are typically charged by the state and vary depending on the size and weight of the RV. In some states, there may also be additional fees for emissions testing or safety inspections.

Insurance costs for RVs can also be higher than for regular cars due to the increased value and potential for damage. Buyers should shop around for insurance quotes and consider factors such as coverage limits and deductibles.

Loan interest is another cost to consider if financing the purchase of an RV. Interest rates can vary depending on the buyer’s credit score and the length of the loan.

Personal property tax is a tax on the value of personal property, including RVs, and is assessed by some states. However, some states may offer deductions for personal property tax paid on RVs.

In addition to these costs, there may be deductions available for RV owners when it comes to income tax. For example, RV owners may be able to deduct the interest paid on their RV loan or personal property tax paid on their RV.

It’s also important to note that some states may charge excise tax on the purchase of an RV, which is a tax on the sale or use of a product. Buyers should check with their state’s Department of Revenue to see if this applies to them.

Finally, buyers should be aware of motor vehicle document fees, which are charged by some states for processing RV registration paperwork. These fees can vary depending on the state and should be factored into the overall cost of purchasing an RV.

RV Ownership and Residency

When it comes to RV ownership and residency, there are a few things to keep in mind, especially when it comes to sales tax. In most cases, RV owners are required to register their vehicles and pay sales tax in the state where they reside or where the RV is primarily located.

For those who live in their RV full-time, establishing residency can be a bit more complicated. Most states require RV owners to have a legal residency in order to register their vehicle and obtain a driver’s license. This can include having a physical address, a mailing address, and proof of residency such as utility bills or a lease agreement.

Some full-time RVers choose to establish residency in states that have more favorable tax laws, such as those with no sales tax on RVs. However, it’s important to note that simply registering in a state with no sales tax may not be enough to avoid paying sales tax in the state where the RV is primarily located.

In some cases, RV owners may be able to establish their RV as their primary residence or secondary home for tax purposes. This can provide certain tax benefits, such as the ability to deduct mortgage interest and property taxes. However, it’s important to consult with a tax professional to ensure that all requirements are met and that the RV qualifies as a primary residence or secondary home.

Overall, RV ownership and residency can be a bit more complex than traditional home ownership. It’s important for RV owners to understand the requirements for registration and sales tax in their state of residence, as well as the potential benefits of establishing their RV as a primary residence or secondary home.

Out-of-State RV Purchase

Buying an RV out of state can be a great way to widen your search and find the perfect RV for your needs. However, it is essential to understand the consequences of an out-of-state purchase. Here are some things to keep in mind.

Sales Tax

One of the most significant factors to consider when buying an RV out of state is sales tax. Each state has different sales tax rates, and some states do not charge sales tax on RV purchases. The five states that do not charge sales tax on new or used RV purchases are Alaska, Delaware, Montana, New Hampshire, and Oregon. If you live in one of these states or on the border, shopping there can save you a fair amount of money.

On the other hand, if you purchase an RV in a state with high sales tax rates, you may end up paying more than you bargained for. In some cases, you may have to pay sales tax in both the state where you bought the RV and the state where you register it. Double check both states’ regulations beforehand.

Registration Fees

Another factor to consider is registration fees. Each state has different registration fees, and some states charge more than others. When purchasing an RV out of state, you may be able to save money on registration fees by buying in a state with lower fees.

Delivery Options

If you purchase an RV out of state, you will need to figure out how to get it home. Some dealerships offer delivery options, which can save you time and money. However, delivery fees can be expensive, so be sure to factor them into your budget.

Travel Costs

If you decide to pick up your RV in person, you will need to factor in travel costs. This includes gas, food, lodging, and other expenses. If you are traveling a long distance, these costs can add up quickly. However, if the RV you are purchasing is saving you a significant amount of money, the extra travel costs may be worth it.

Professional Assistance and Resources

Navigating the different RV sales tax laws in each state can be a complicated process. Fortunately, there are resources available to help RV buyers make informed decisions and avoid costly mistakes.

One option is to seek the advice of a tax professional or lawyer who specializes in RV sales tax laws. They can provide valuable guidance on how to minimize sales tax liability and ensure compliance with state regulations. Additionally, they can assist with paperwork and other legal requirements to complete the sale.

RV dealers can also be a useful resource for buyers. They are familiar with the sales tax laws in their state and can provide guidance on how to properly register and title an RV. Some dealers may even offer financing options that can help buyers manage the cost of sales tax.

For those who prefer a do-it-yourself approach, there are several online resources available like RV forums or message boards full of helpful RVers who are ready to share firsthand experience and respond to RV-related questions.

RV as a Business Expense

When it comes to business expenses, many RV owners wonder if they can write off their RV as a business expense. The answer is yes, but there are certain conditions that must be met.

Firstly, the RV must be used for business purposes at least 50% of the time. This means that the RV must be used for activities that are directly related to the business, such as traveling to meet clients or attending trade shows.

Secondly, the RV must be used for business trips that are shorter than 30 days. This is because the RV will only count as transient lodging if the business trip is shorter than 30 days.

If these conditions are met, the RV owner can deduct expenses related to the RV as business expenses. This includes expenses such as gas, maintenance, and insurance.

It is important to note that if the RV is used for personal purposes, the expenses related to those personal purposes cannot be deducted. For example, if the RV is used for a family vacation, the expenses related to that vacation cannot be deducted as a business expense.

In addition, it is important to keep accurate records of all expenses related to the RV. This includes keeping receipts and tracking mileage. This will make it easier to calculate the amount that can be deducted as a business expense.

Ultimately, while it is possible to write off an RV as a business expense, it is important to ensure that the conditions are met and that accurate records are kept.

RV Purchase Considerations

When purchasing an RV, there are several factors to consider in order to get the best deal within your budget. Timing and location can play a big role in the cost of your RV purchase.

One consideration is the best month to buy an RV. Typically, the best time to buy an RV is during the off-season, which is usually from November to January. During this time, dealerships are looking to clear out inventory from the previous year and make space for new models. This can result in lower prices and more negotiating power for buyers.

It is also important to consider the overall cost of ownership. While a cheaper purchase price may seem like a good deal, there may be hidden costs to consider such as maintenance, repairs, and insurance. It is important to factor in these costs when determining your budget for an RV purchase.

When purchasing an RV, it is also important to find a unit that fits your needs. This can help you get more use out of the unit, which can make the cost of ownership drop considerably. It may be helpful to make a list of your must-haves and nice-to-haves before starting your search.